Welcome to the ArrowCreek monthly property value update for a High Desert, Semi-Rural community in Washoe County, Nevada, that was designed to incorporate an independent, PRIVATE Golf Course, commercial business (A.K.A. the Non-Residential Area as documented in the Articles of Incorporation, the Covenants, Conditions and Restrictions (CC&Rs) and By-Laws). Participation in the private club (i.e., HOA residents do not have a financial interest nor obligation to ‘The Club,’ which is not true for all Associations) is purely optional for interested and “approved” parties. The origins of this report were based on a heated discussion of the value of homes on a golf course versus those not on the golf course, which is likely different for other communities, and, as you’ll observe, the belief that homes on a course are worth more is a ‘belief,’ especially in this time of inflation, rising interest rates and decreasing sales.

The ArrowCreek community is financially diverse having been created that way by the designer of the community and Washoe County in 1997. It consists of 506 Semi-Custom homes, typically for middle and upper middle-income individuals, and 577 Custom home sites (all started out as vacant lots), typically for upper middle and high net worth individuals, of which 489 custom homes have or are being built. Approximately one third of all the lots, both custom and semi-custom, are directly adjacent to the golf course (~361). This report contains the data that was available on March 26, 2023, from the Washoe County Assessor’s Records. These records appear to be current but may be up to two weeks behind.

With interest rates rising, the number of properties changing owners was once again 5 (five) properties. This data appears to be in agreement with national publications and local real estate and banking professionals. Home price growth has definitely slowed and in fact, as you’ve read elsewhere, declined over the past four to eight months. Our year-over-year price gain of 11.1% (This number is highly suspect as the sale of homes, on the golf course, has fallen into a never-never land of statistical significance.) from last month dropped to 7.8% this month. This occurred while over in the Bay Area, according to REDFIN, the annual ‘increases’ were San Francisco -6.7%, Oakland -4.5% and San Jose -3.2% and nationally -0.2%, ArrowCreek absolutely competes with the top markets in terms of value but we may be in for a period of decreasing valuations. For instance, there was a recent foreclosure in our community that went for 25% of current market values (this property was not included in our monthly survey statistics). Additionally, homes not adjoining the golf course have exhibited a -3.3% decline over the past year. ‘Raw’ property in our ArrowCreek community has fallen statistically ‘out-of-contention,’ however, one vacant lot was sold this past month.

Since April of 2022 and over the past twelve (12) months:

1. Custom ArrowCreek homes appear to have established a ‘floor’ of $460 per square foot and Semi-Custom homes an identical ‘floor’ of $400 per square-foot to grow from. With only four fully financed properties changing hands this past month, there wasn’t a most active neighborhood.

On with THE FACTS:a.) Five (5) properties were recorded sold in ArrowCreek between 15 February and 15 March (per the Washoe County Assessor). This brings the total number of properties transferred over the past rolling year to 51 or 4.7% turnover rate for our community. From a National Publication (TheHill.com), this compares to the fact that only 8.4% of Americans live in a different home than they did a year ago and in Washoe County the number is 18.4% based upon the most recent census data. The aging of the U.S. population, a lack of new housing, and increased caution have produced the lowest rate of mobility recorded at any time since 1948. ArrowCreek continues to have a very low turnover rate which may be attributed to a general satisfaction with living in our gated community. In fact, 192 (17.7%) of us have lived or owned property in ArrowCreek for more than 16 years.

b.) One home was recorded as sold on the golf course (where the property boundaries actually touch the golf course property, not just have a ‘view’ of it) during this reporting period. We use a 12-month rolling average to normalize home and land prices. The number of homes sold, in the ‘golf course’ category, barely meets the criteria for statistical analysis (11). As a consequence, the observed price escalation is once again highly suspect and may portend a significant decrease for selling prices. The rolling average selling price for homes on the golf course decreased to $519.81 per square foot. The theoretical price per square foot decreased by $4.11 per square-foot due to the rolling year statistical calculation. The 12-month rolling average sales price increased to $2,548,181.82. One vacant parcel was sold over the previous 12-month period for $349,219.39 per acre.

c.) Three (3) homes but no vacant property was sold not connected to the golf course. The rolling average selling price for off-course homes decreased to $446.17 per square foot, which is down by $6.45 per square foot, based on a sample size of 35 homes. The twelve-month rolling average sales price for non-golf course homes decreased to $1,637,314.26 from last month’s $1,662,944.42. No vacant lots were sold this past month, making the rolling 12-month average selling price for vacant land, not on the golf course, decrease to $333,213.30 per acre. This value is very suspect as only four properties changed hands during the past year and, statistically, the value cannot be relied upon.

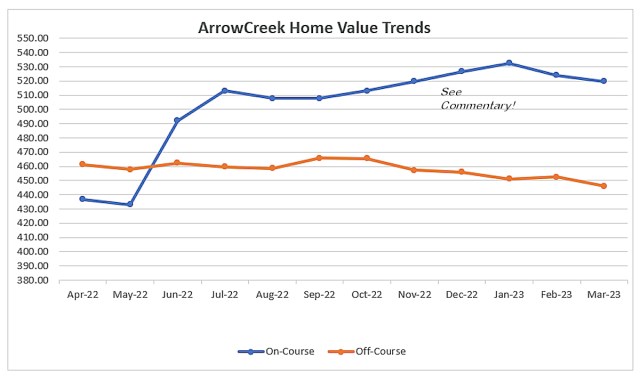

d.) The figure below shows the value trends over the past twelve months with the vertical scale being the cost per square foot. It should be noted that the ‘spike’ in golf course home values in May of 2022 was caused by a single home sale. This can happen when there are a small number of homes to average across. However, when the over-all trend is observed it’s apparent that our values have been decreasing from June/July 2022. Additionally, it was noted that five years ago the nominal price per square foot was on the order of $200 as opposed to where they are today. With the absence of ANY sales on the golf course a couple of thoughts come to mind. First, people are extremely happy here and don’t need or want to move on. Second, they may have had a dream of ‘making it,’ and a symbol of ‘arriving’ is the nice house on a golf course. In any case, homes are still being sold, just at lowered values.

Another interesting observation was provided recently that may account for some or most of this difference. The observation was from a Damonte Ranch resident who belongs to ‘The Club.’ “I get all the ‘amenities’ of ArrowCreek with my golf membership without the ‘high cost’ of owning a home there.” Something to ponder, as this ‘attitude’ may cause our prices to go lower to match those ‘down in the valley’ and, in fact, there is some evidence that that phenomenon is happening. Certainly, the lack of home sales adjoining the golf course may be one such indicator.

! Statistically this is not supportable.

2. With Winter and inflation continuing along with interest rate increases to cool down inflation. The housing market continues to be barely alive. For those desiring a secure, safe environment with majestic views to raise a family, with abundant recreational opportunities, excellent schools, shopping, medical services and peace of mind, ArrowCreek should not be overlooked.

Do keep in mind that everyone’s selling price is based upon his or her own set of circumstances and the above picture/figure is hindsight, not necessarily foresight. In point of fact, it is distorted due to the lack of sales of golf course homes. From the volume of property transfers during this reporting period it is clear that the demand for a secure property environment has remained, although at a lowered level. A balanced marketing approach focused on our amenities and relatively low fees should go a long way toward creating a better environment for all homeowners and buyers.

Continuing with the commentary from previous months: the author received queries about Semi-Custom and Custom homes both on and off the golf course and their relative selling prices with respect to those found in Reno and Sparks. The following chart portrays the trend lines for Custom and Semi-Custom homes within this broader community. From the chart it is clear that home values have been steadily increasing since February 2022. Furthermore, the values of Custom homes within Truckee Meadows, especially those in Reno and within ArrowCreek, have managed to exhibit nearly the same value trends. Also, the values of Semi-Custom homes, of comparable home and land size, indicate that both Reno and Sparks offer greater dollar value per square foot than ArrowCreek from a pure price perspective but not from a secure and safe environmental perspective. ArrowCreek’s value lies in our gated security, views, quality of adjacent schools and our other amenities which amounts to a premium of about $50 per square-foot for our Semi-Custom homes. Obviously, this is not true for our Custom homes as we enjoy the same ambience, but there is little price difference between them and Reno Custom homes. ArrowCreek homes are $30 more expensive per square foot.

! Statistically this is not supportable.

For the past month the ArrowCreek rolling averages are:

- Semi-Custom On-Course: $479.97 per Square Foot (**only 2 properties)

- Semi-Custom Off-Course: $414.21 per Square Foot (18 properties)

- Custom On-Course: $528.67 per Square Foot (**only 9 properties)

- Custom Off-Course: $480.01 per Square Foot (17 properties)

-

- We also received a request from one of our readers for a comparison of the ArrowCreek values with those in D’Andrea (Sparks market), Somersett (Reno market) and Saddlehorn. Having obtained the appropriate reports from the real estate community, here is what was learned. (Data extracted from altosresearch.com Chase International)

-

-

- Reno market ‘in general’ – Custom homes in Reno are selling, on average, for $433.90 per square foot (Median price $1,650,000). The average days on the market was 126 days. ArrowCreek average time on market was unavailable. Reno homes comparable to ArrowCreek Semi-Custom homes are selling, on average, for $327.72 per square foot (Median price $925,000) with a time-on-market of 84 days. Median prices fell across the Reno market by 3.6% during the comparable past year, as you can see from the chart, while ArrowCreek combined average, validated, prices were 5% lower (values for golf course homes were not used due to statistical quality of the data).

-

-

-

- Sparks market ‘in general’ – Over the past year a number of homes in Sparks have been identified as qualifying for ‘custom’ designation. These homes are definitely comparable to those in ArrowCreek from both a square footage and lot size perspective. The current average selling price for these homes is $290.79 per square foot (Median price of $882,500) with a time on market of 59 days. The Sparks Semi-Custom market actually compares with the Semi-Custom homes in ArrowCreek. The average price for these Sparks homes is $280.24 per square foot (Median price $656,997) with an average of 50 days on the market. Median prices rose across this market by 0.9% during the comparable past year. It’s worth noting that the Sparks Semi-Custom market includes the D’Andrea market and with the revitalization of their golf course over the past two years, there hasn’t been an appreciable or corresponding increase in home values.

-

Commentary: ArrowCreek Custom homes continue to be in the top two quartiles of Reno and the Semi-Custom homes are in the top quartile of Reno and Sparks. In an exchange with one of our readers the following conversation took place:

“Living in a gated community with a refurbished club house and golf courses with a thriving membership (39%) must have some impact on our ArrowCreek home values intuitively speaking. At least it is better than a shut-down golf course that impacts home values because of uncertainty. I would think that the Conrad’s and The Club’s investment in the community has absolutely made a difference in the home values but I have no basis to make an estimate. Do you have any data?”

RESPONSE: Intuition is a great thing and goes right beside ‘belief.’ Conrad’s investment in the ArrowCreek commercial zone should be welcomed but kept in perspective with community goals and aspirations. The ‘data’ I would offer is, dependent on what baseline you’d like to choose, from November 2021 to present, our homes have increased in value 17%, twice the inflation rate, and the rest of Truckee Meadows by 9.6%, even for homes in a ‘golf community with larger assessments and fees. So, I ask you, has their investment in their private club had an effect?” The data suggests that the ‘private’ golf course (a.k.a. The Non-Residential Area of ArrowCreek) has little or a negative impact on prices because ArrowCreek homes are selling at roughly comparable non-gated community homes in the Truckee Meadows based upon real estate advertising and the data compiled in this report. Also, the ArrowCreek Homeowners Association (ACHOA) does not, repeat does not, have a financial or any other fiduciary interest in ‘The Club at ArrowCreek (TCAC).’ TCAC is not an amenity of ArrowCreek. It is a separate and private commercial enterprise and should be supporting the greater community as a result.

Some owners of ArrowCreek believe they reside in a ‘golf community.’ Those words appear to emanate from those who have chosen to belong to the ‘private’ golf club. In their minds, it may be true; however, in fact, the truth is that only a third of the homes and lots are on the golf course and approximately 39% of all owners are actually members of ‘The Club.’ Yes, we have a private golf club within our gated community that is not an HOA amenity, but we also enjoy the freedom to belong or not.

The ‘value proposition’ for our unique community should continue to focus on attracting professionals who value security, views, recreational opportunities, good schools, near-by shopping/entertainment, excellent medical services, and the quietude of the High Desert. Realtors will continue to show prospective new Nevadans lower priced housing options but in the end people who value our advantages will settle in ArrowCreek. People will come to ownership in ArrowCreek as Nevada businesses gather top talent with competitive salaries.

Please consider contributing your knowledge and energy to make our HOA better for all owners.

By Ron Duncan

March 31, 2023

For previous postings of the ArrowCreek property value updates: click here.

thank you for doing this.

LikeLike